Tax Credits 2025 For Single Person

Tax Credits 2025 For Single Person - How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube, Tax credits can come in handy when tax filing season rolls around. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit. Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Married person or civil partner. People should understand which credits and deductions they can claim and the records they.

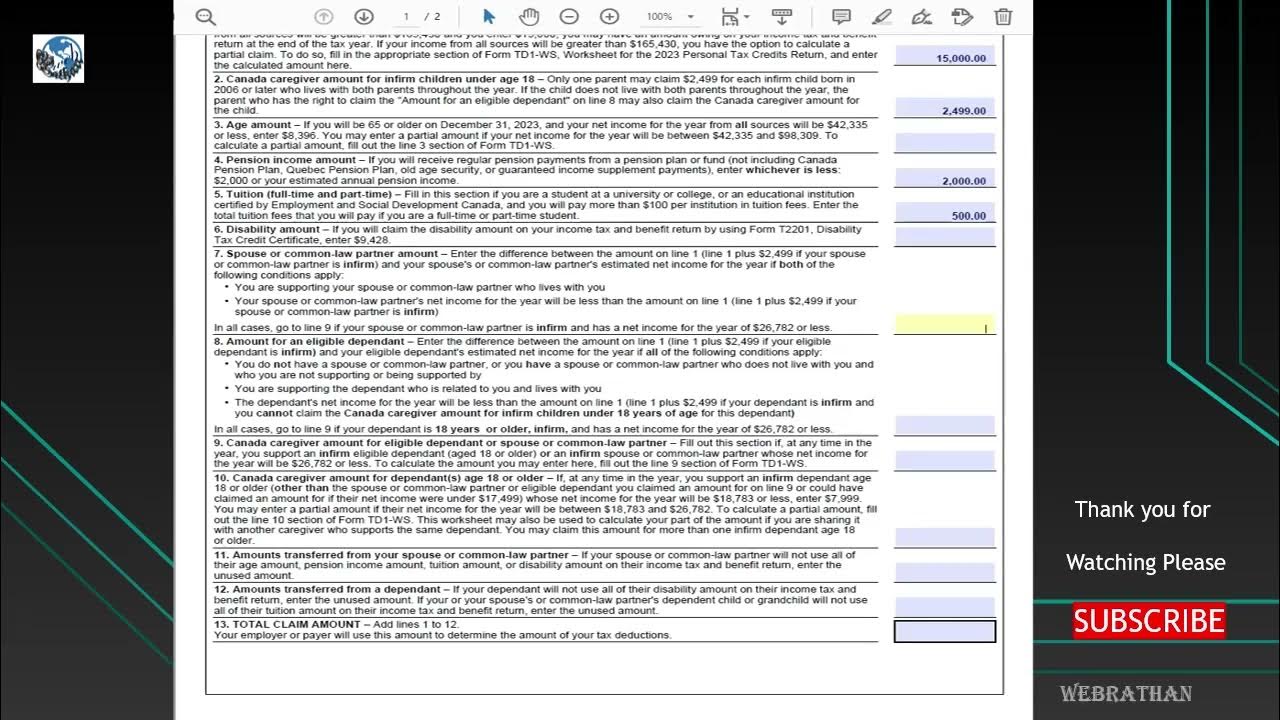

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube, Tax credits can come in handy when tax filing season rolls around. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit.

Advanced Premium Tax Credit Eligibility, Limits, Amount & How, Bc 5.06% yt (1) 6.40%: The irs applies the tax rates to your taxable income to find how much tax you actually owe for the year.

Married person or civil partner: Tax credits can come in handy when tax filing season rolls around.

The department for work and pensions (dwp) plans to move all existing tax credit claimants onto universal credit by the end of 2025.

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, Married person or civil partner. Employee tax credit (formerly known as the paye tax credit) €1,875:.

Tax rates for the 2025 year of assessment Just One Lap, For tax returns filed in 2025, the tax credit ranges from $600 to $7,430, depending on tax filing status, income and number of children. Bc 5.06% yt (1) 6.40%:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Tax credits can come in handy when tax filing season rolls around. Widowed person or surviving civil partner with.

Tax Rates 2023 To 2025 2023 Printable Calendar, Tax credits and deductions for individuals. $13,850 for single or married filing separately $27,700 for married couples filing jointly or qualifying surviving spouse $20,800 for head of household find the.

Sovereign Gold Bond 2025 Dates. The reserve bank of india (rbi) has released the details […]

Top 10 Meilleur Artiste Africain 2025. La créativité africaine à son apogée : Concerts sur […]

Age tax credit if single, widowed or surviving civil partner.